Management Policy and Strategy

Management policy

Guided by its corporate philosophy of “Information Revolution — Happiness for everyone,” SoftBank Corp. (the “Company” or “SoftBank” or “we”) and its subsidiaries (the “Group”) has been aiming to become a corporate group needed most by people around the world. We are developing a variety of businesses in the information and technology field while enhancing our telecommunications business and are working to maximize our corporate value by using the power of technology to solve social issues.

Vision & StrategyGrowth strategy

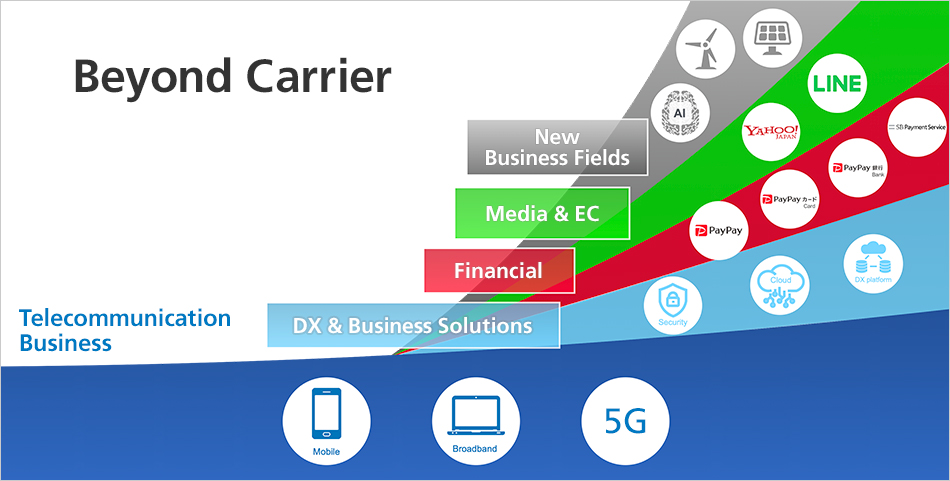

SoftBank Corp.'s “Beyond Carrier” growth strategy aims at sustainable growth in our core telecommunications business, while at the same time going beyond just being a telecommunications carrier to actively roll out new businesses in the information and technology field, with the aim of maximizing corporate value. In addition, by further strengthening ties between telecommunications business and those group businesses, we are promoting the creation of synergies, such as increasing the number of service users and enhance user engagement in the group businesses, while strengthening the competitiveness of the telecommunications business.

Medium-term Management Plan

In May 2023, we announced our Medium-term Management Plan ending in FY2025.

Please refer to the presentation material for details.

Medium-term Management Plan (PDF: 10.6MB/55 pages)

Please refer to the earnings results briefing presentation material for the progress of the Medium-term Management Plan. Financial targets and non-financial targets of the Medium-term Management Plan were upwardly revised at the earnings results briefing in May 2025. Please refer to “Financial targets” and “Non-financial targets” below.

Financial targets

Net income attributable to owners of the Company in FY2025:

Pursue record-high profit (¥540.0 billion)

The targets for FY2025 are as follows.

| Targets in the Medium-term Management Plan (FY2025) | |

|---|---|

| Net income attributable to owners of the Company | Pursue record-high profit (¥540.0 billion) (Upwardly revised from ¥535.0 billion in May 2025) |

| Operating income | Aim for operating income of ¥1 trillion while strengthening upfront investments for mid- to long-term growth (Upwardly revised from ¥970.0 billion in May 2025) |

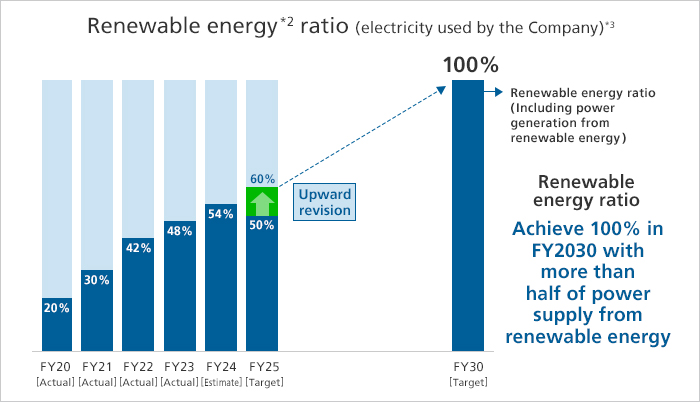

Non-financial targets

Procure all electricity needed for telecommunications business

from renewable energy generation, with more than half of

electricity generated from renewable energy by FY2030

| Ratio of renewable energy*2 of electricity consumption by the Company*3 | FY2025: 60% (Upwardly revised from 50% in May 2025) FY2030: 100% |

|---|

To achieve this target, we will not only use non-fossil certificates, but also promote energy conservation at our base stations, which account for half of our annual greenhouse gas emissions. In addition, we have entered into a major contract with a power producers to newly procure renewable energy*4, which we also expect to contribute to achieving our targets.

We have set “contributing to the global environment with the power of technology” as one of our material issues. We will contribute to the realization of a decarbonized society by utilizing cutting-edge technologies such as artificial intelligence (AI).

Material Issues

Shareholder returns

Focus on Both Medium- and Long-term Growth

and Shareholder Returns

We consider the return of profits to shareholders to be an important goal for our management along with increasing medium- to long-term corporate value. To increase corporate value, we will make capital investments efficiently to further raise the sophistication of 5G, as well as continuing investments in new businesses such as building AI computing infrastructure. Our basic policy is to distribute surplus twice a year as interim and year-end dividends, and to pay attention to the stability and sustainability of dividends while considering factors such as performance trends, financial condition, and cash flow position on a comprehensive basis.

For the fiscal year ending March 31, 2026 (FY2025), the annual dividend per share is planned to be ¥8.6 (of which, interim dividend of ¥4.3 and year-end dividend of ¥4.3) for common shares, and a prescribed amount of dividend is planned for the Series 1 Bond-Type Class Shares and the Series 2 Bond-Type Class Shares.

We will continue to grow both telecommunications business and new businesses, striving to increase its corporate value and deliver stable returns of profit to shareholders.

Shareholder Returns and Dividends- [Notes]

-

- *1Net Income: net income attributable to owners of the Company

- *2Includes the use of non-fossil certificates designated as renewable energy

- *3Total of SoftBank Corp. and Wireless City Planning Inc.

- *4Mainly renewable energy with additionality (effect of encouraging additional new renewable energy generation capacity)

- *1