Corporate Governance System

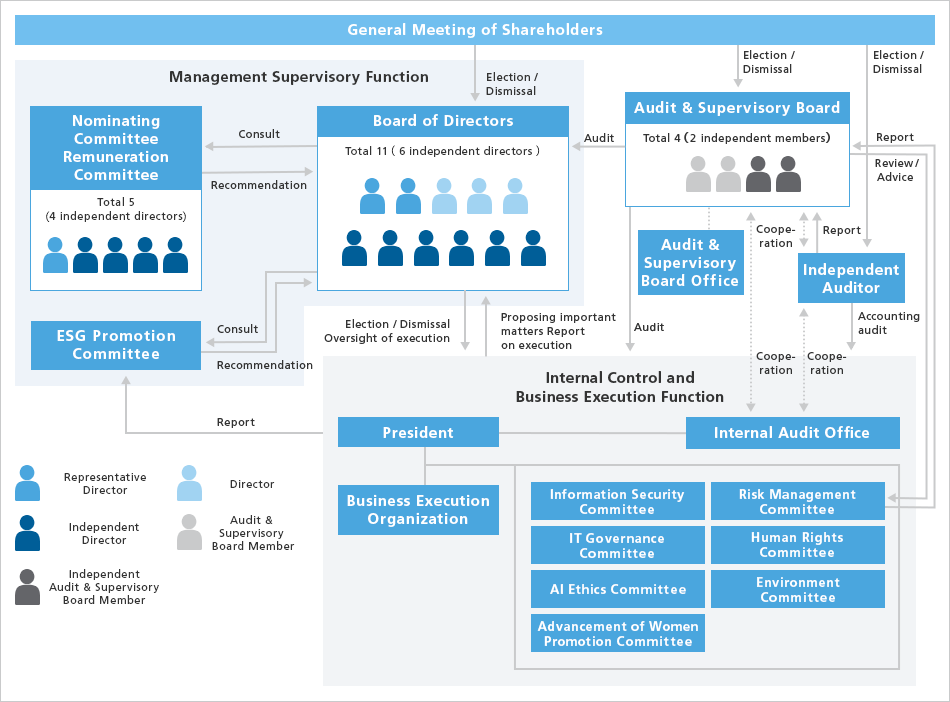

Corporate governance system

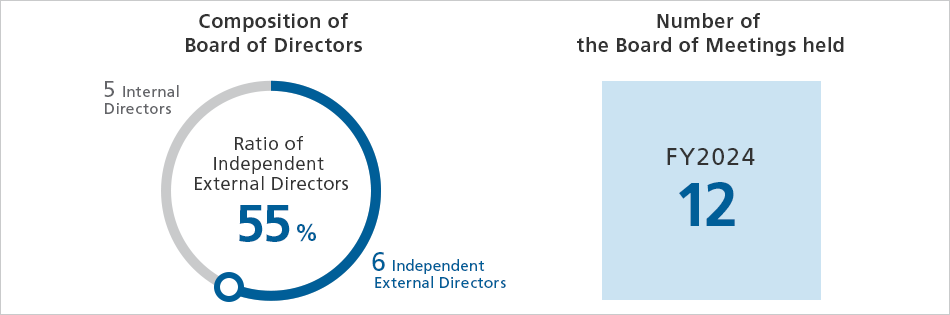

The Company has established the Board of Directors as a decision-making body for important matters and an oversight body for the status of business execution. The Board of Directors also plays a role of steering management to improve the long-term enterprise value. At present, the Board of Directors consists of 11 directors, including six external directors, and decision-making by the Board of Directors is based on appropriate information provided in advance and after thorough discussions.

In addition, the Company has established the Audit & Supervisory Board to conduct efficient and effective audits regarding the status of execution of duties by directors. The Audit & Supervisory Board consists of four Audit & Supervisory Board Members, including two external Audit & Supervisory Board Members, and formulates the audit policy, audit plan and audit method. Audit & Supervisory Board Members carry out audit activities in accordance with this policy and plan.

Moreover, the Company has introduced the executive officer system to ensure clarification of the management supervisory function, strengthening the business execution function of the Board of Directors, and expediting management.

The Company's corporate governance structure is as follows:

Overview of corporate governance system

| Organization Structure | Company with an Audit & Supervisory Board |

|---|---|

| Number of Directors | 11 (6 of whom are Independent Directors) |

| Number of Auditors | 4 (2 of whom are External Audit & Supervisory Board Members) |

| Chair of the Board of Directors | Junichi Miyakawa (President & CEO) |

| Adoption of an Executive Officer System | Yes |

| Advisory Committee of the Board of Directors | Nominating Committee and Remuneration Committee ESG Promotion Committee |

| Executive Remuneration System |

(1) Basic remuneration: Annual basis by position, which shall be paid in cash in monthly installments. (2) Short-term performance-based remuneration: Paid as stock-based compensation multiplied by a payout ratio based on the degree of achievement of performance and other targets for the current fiscal year. (The form of restricted stock) (3) Medium-term performance-based remuneration: Paid as stock-based compensation every three years multiplied by a payment rate based on the status of the Company's TSR over a three-year term. (The form of restricted stock)

|

Corporate governance structure

Board of Directors

The Company's Board of Directors is a decision-making body for important matters and an oversight body for the status of business execution. It also plays a role in steering management to improve long-term corporate value. The Company's Articles of Incorporation stipulates that the number of Board Directors must be 15 or less.

Their terms of office last until the conclusion of the Ordinary General Meeting of Shareholders held with respect to the final fiscal year ending within one year after election. The Board of Directors elects, as candidates for Board Director, those who are considered the most suitable for the position in consideration of their nationality, ethnicity, gender, and age, based on discussions by the Nominating Committee.

As of June 2025, there are 11 Board Directors serving, including six independent external directors, who hold constructive and lively discussions from diverse perspectives, including outside perspectives. Furthermore, the Company has introduced an executive officer system for ensuring clarification of the management supervisory function and strengthening the business execution function of the Board of Directors, as well as expediting management.

The Board of Directors, in principle, convenes on a monthly basis to engage in continuous deliberations on key matters, including management strategy, finance, governance, ESG, and investments in AI. Furthermore, following Board meeting, strategic discussions are regularly conducted, providing an opportunity to deepen perspectives on medium- to long-term management challenges and the Company's future directiont.

Main topics discussed (FY2024)

- Corporate management

- Financial matters

- Matters related to the acquisition of land and buildings for the construction of AI data centers

- Matters related to the construction of international submarine cables

- Matters related to results and forecasts of business performance and business KPIs

- Matters related to affiliated companies

- Matters related to risk management

Supporting System for External Directors

and/or External Audit & Supervisory Board Members

The Company is focusing on efforts to strengthen communication and information sharing between internal and external officers so that external officers can maximize their management oversight function, improve the effectiveness of the Board of Directors, and provide general management advice.

Briefing session of the Board of Directors meetings

Prior to each Board of Directors meeting, a briefing session is held for the external directors and Audit & Supervisory Board members. With the CFO and/or other appropriate officers attending all these meetings, the departments in charge provide detailed explanation of the agenda items, followed by a question-and-answer session to ensure a clear understanding from the external directors and Audit & Supervisory Board members. In addition, in cases where issues are raised by external directors at such briefings, the department in charge clarifies such issues before the Board of Directors meeting.

Various meetings

To make monitoring by the Board of Directors more effective, various initiatives are implemented throughout the year to enable external directors to obtain and share information necessary for monitoring outside of the Board of Directors meetings.

Number of meetings (FY2024)

- Strategic Discussions (6 times)

- Briefing session of the Board of Directors meetings (12 times)

- Executive Directors and External Directors Exchange Of Views (1 time)

- Directors, Auditors and Executive Officers Discussion (10 times)

- External Directors and Auditors Information Exchange Meeting (2 times)

- External Directors and The Independent Auditor Discussion (1 time)

- External Directors regular Conference (4 times)

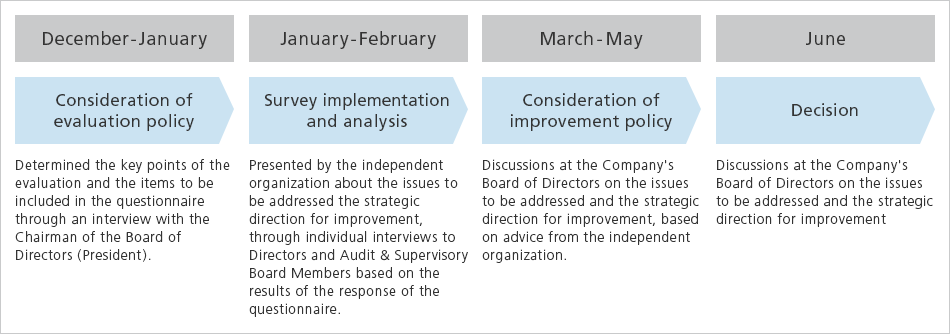

The evaluation of the effectiveness of the Board of Directors

In order to further ensure its effectiveness and to improve its functions, the Company's board of directors analyzes and evaluates the effectiveness of the board of directors every year.

A summary of the method and results of the evaluation of the effectiveness of the Company's board of directors for FY2024 are as follows:

Evaluation method

| (1) Subjects of evaluation | Five Internal Directors, six External Directors, and four Audit & Supervisory Board members |

|---|---|

| (2) Method of evaluation | Questionnaire-based survey (in a signed form) and/or interview |

| (3) Evaluation period | From December 2024 to June 2025 |

Evaluation process

The major question items in the questionnaire for FY2024 are as follows. Each question is rated on a 5-point scale, with a free comment box provided for each item.

- Strategies and implementation thereof

- Risk and crisis management

- Corporate ethics

- Business restructuring (mergers, acquisitions, divestitures or business alliances)

- Group governance

- Management evaluation, remuneration, and succession planning

- Dialogue with stakeholders

- Structure and operation of the board of directors

Status of responses in FY2024 to the issues of FY2023

| Issues | Initiatives and Results | |

|---|---|---|

| FY 2023 |

Medium- to long-term strategies |

|

| Next-generation human resources strategies |

|

|

| Group governance and risk management |

|

Priority issues to be addressed going forward

| Issues | Action Plans | |

|---|---|---|

| FY 2024 |

Medium- to long-term strategies |

|

| Next-generation human resources strategies |

|

|

| Group governance and risk management |

|

Issues identified in the past and status of responses

Transactions with controlling shareholder

The Company recognizes that related party transactions including transactions with the parent company group are transactions that may have an impact on the financial position or the results of operations by using the advantageous position of the related party.

As such, in implementing related party transactions, the Company carries out important transactions upon approval of the board of directors each time, by paying particular attention to whether such transactions are rational from a managerial standpoint of the Group and whether the terms and conditions of the transactions are appropriate compared to external transactions, in accordance with the Related Party Regulations and Related Party Transactions Management Manual.

Among these transactions, for the ones that are particularly important, a structure was established around the Independent Outside Directors' Meeting, comprising exclusively independent external directors. The priority of the Independent Outside Directors' Meeting is to protect the interests of minority shareholders and is intended to further invigorate discussions at the board of directors from that perspective. The meeting engages in the prior consideration of matters in the same way as the former special committee.

Even with regard to related party transactions that do not fall under important transactions, the Finance and Accounting Division monitors the aggregate amount and details of such transactions once a year in principle.

In addition, the Board of Directors Rules stipulate that the board of directors must approve transactions conducted by directors if these may compete or cause conflicts with the Company's interests. Each transaction is subject to approval by the board of directors and the transaction results are reported to the board of directors.

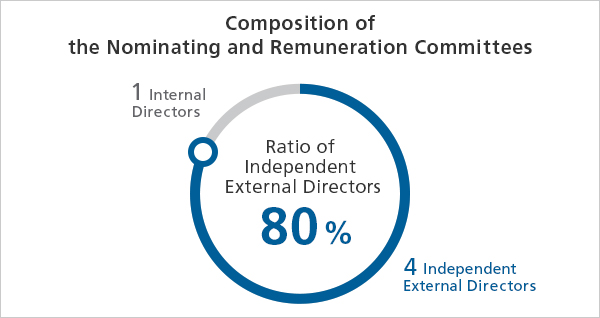

Nominating Committee and Remuneration Committee

The Company has voluntarily established the Nominating Committee and the Remuneration Committee. As of June 30, 2025, each committee is composed of the President & CEO and four independent external directors and chaired by an independent external director to ensure its independence. Both committees deliberate and determine recommendations to be submitted to the General Meeting of Shareholders. The Nominating Committee deals with the election and dismissal of Board Directors and the nomination of Representative Directors, while the Remuneration Committee handles remuneration for Board Directors.

Main topics discussed (June 2024 to May 2025)

Nominating Committee

Structure of the Board of Directors, election of Board Directors, nomination of Representative Directors, Board Director's skill matrix

Remuneration Committee

Remuneration by position, performance-linked indicators, disclosure documents, individual remuneration amounts

Audit & Supervisory Board

The Company has established an Audit & Supervisory Board to conduct efficient and effective audits regarding the status of execution of duties by Board Directors. It consists of four expertAudit & Supervisory Board Members rich in knowledge and expertise, including two external Audit & Supervisory Board Members.

The Audit & Supervisory Board meets once a month in principle. It examines risks and issues in the five areas of Board Directors, business execution, subsidiaries, internal audits, and accounting audits. It also sets annual activity plans, and makes proposals and recommendations to Board Directors and executive departments on matters recognized through audit activities.

Internal audits

Established as an independent organization directly under the President & CEO, the Internal Audit Department conducts internal audits of the overall duties of the Company as well as company-wide internal control audits of its subsidiaries and affiliates (mainly consolidated subsidiaries), by setting the goal of “achieving management goals and increasing value” and by formulating a risk-based annual audit plan based on the philosophy of “audits that contribute to management.”

The annual audit plan is submitted to the Board of Directors for resolution each year. The process of formulating the plan not only incorporates the perspective of company-wide risks recognized by the Representative Directors and the management (board directors, external directors, unit heads, executive officers, division heads, etc.), but also takes into consideration the opinions of the Audit & Supervisory Board Members and Independent Auditor (Deloitte Touche Tohmatsu LLC).

In addition, at the end of the first half of the fiscal year, management interviews are conducted again to review the annual audit plan on a rolling basis, which enhances internal audits in line with changes in the management and business environment and risks surrounding the Company.

Cooperation among Audit & Supervisory Board Members,

Independent Auditors and Internal Audit Departments

| Cooperation between the Audit & Supervisory Board Members and the Independent Auditor | The Audit & Supervisory Board Members receive briefings from the Independent Auditor (Deloitte Touche Tohmatsu LLC) on the audit policy and audit plan, and exchange opinions. The Audit & Supervisory Board Members receive reports on the main items to be audited and the method and results of audit, regarding the audit during and at the end of the fiscal year (including quarterly review). Full-time Audit & Supervisory Board Members cooperate with the independent auditor mainly by exchanging information and opinions with the Independent Auditor on a monthly basis, as well as accompanying the Independent Auditor who conducts accounting audits and attending the audits. |

|---|---|

| Cooperation between the Audit & Supervisory Board Members and the Internal Audit Department | The Audit & Supervisory Board Members regularly provide opportunities to exchange information with the Company's Internal Audit Department and Internal Control Division, cooperating organically with them including requesting them to conduct an investigation as necessary. In particular, the Audit & Supervisory Board Members confirm the progress of the internal audit plan and exchange opinions with the Internal Audit Department every month such as by holding regular meetings attended by full-time Audit & Supervisory Board Members. In addition, the general manager of the Internal Audit Department reports the internal audit plan and results, among other matters, to the Audit & Supervisory Board Members semi-annually, and provides explanation regarding the report of audit results to representative directors as appropriate, through sharing of materials each time. |

| Cooperation between the Independent Auditor and the Internal Audit Department | The Independent Auditor receives briefings from the Internal Audit Department on the audit plan and, when necessary, on the results of Internal Audits and other matters. The Internal Audit Department receives regular briefings from the Independent Auditor regarding audit results and other matters. Moreover, both parties cooperate with each other as necessary by exchanging information and opinions, among other measures. |